Here, you will learn everything you need to know about High Wave Candle.

What is a High Wave Candle?

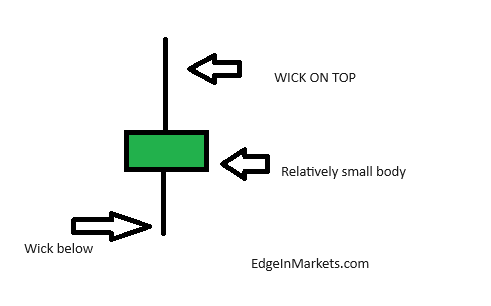

High Wave Candle is a specific type of candlestick pattern that often signals indecision or a potential reversal in market sentiment.

The High-Wave Candlestick is characterized by its long upper and lower wicks relative to the candle’s body. Indicating that the price is stagnant and there might be a momentum shift

Characteristics of High Wave Candle

The main reason behind a High Wave Candle is indecision; buyers are getting weak if it appears on an uptrend.

If it appears in a downtrend, it indicates weakness on the seller’s side, and we should expect a short-term reversal.

- It has wicks on both sides, up and down.

- Small body relative to the candle range

How to Trade it?

High Wave Candle appears usually at the end of an Uptrend or a Downtrend. It shows indecision between buyers and sellers.

This chart shows CYTO; after the pre-market gap, the price stalled at the highs, and we see the High wave candle forming.

We enter a short position anticipating reversal; this trade ends up doing 30%

It is essential to wait for other confirmation before jumping on a trade purely out of candlestick patterns.

Risk management

Managing risk for this trade depends entirely on the trader’s strategy; the most common entry is to wait for the candle to close. Enter with stop loss above or below the High

Summary

Traders interpret the presence of high-wave candles as a reflection of market indecision. They may signify a battle between buyers and sellers, with neither side gaining significant control over the direction of the price. As such, high-wave candles often appear at potential turning points in the market, such as trend reversals or periods of consolidation.

Learn more here: Day Trading Strategies: Real Examples From Real Traders [2024]